Charles Hoskinson said Cardano is tracking toward a hard fork “next month,” while the long-discussed Leios scalability work remains on schedule for “this year,” in a Feb. 19 livestream recorded after a trip through Japan and a stop at Consensus in Hong Kong.

Hoskinson framed the next few weeks as a convergence point for two parallel roadmaps: Cardano’s protocol and developer-stack upgrades on one side, and the Midnight network launch he expects “coming next month” on the other, an effort he described as unusually difficult to execute even for teams with prior experience shipping major chains.

Cardano Momentum: Midnight, LayerZero And USDCx

In the livestream, Hoskinson spent his opening stretch recapping what he characterized as a productive Consensus week, pointing to “a lot of great announcements” and relationships around the Midnight ecosystem, including infrastructure and distribution names he said were involved with the network. He argued that the ability to launch a large, exchange-listed project like Midnight is itself a signal about Cardano’s maturity as a platform for “tier one” efforts.

On the Cardano side, he highlighted a newly announced LayerZero integration that he said connects Cardano “to more than 80 blockchains,” positioning it as a step away from the perception that the network operates in isolation. In the same segment, Hoskinson pointed to USDCx as a stablecoin-like asset he said is designed for “these non-EVM systems,” and emphasized the user-experience work around exchange flows—“autoconvert,” as he described it, so users can move value “straight to the exchange, straight back from the exchange.”

He also drew a distinction between USDCx and “basically USDC,” saying the tradeoff for Cardano users is an asset that, in his telling, preserves “privacy” and “can’t be frozen.” Hoskinson positioned that as “the best compromise” available for a “tier one stablecoin of that nature” in the Cardano ecosystem, while arguing that the LayerZero integration could open the door to “eight major stablecoins” over time, depending on integration sequencing.

Hard Fork ‘Next Month,’ Leios ‘This Year’

The most concrete near-term timing signal came when Hoskinson addressed the protocol schedule directly, saying: “Cardano hard fork is happening I believe next month. But you know the community is kind of working its way through that and getting these things done.”

In the same breath, he reiterated that Leios, Cardano’s scalability initiative, remains on track, noting recent travel and discussions with product manager Michael Smolenski about progress. “All things considered we’re pretty happy with the rate of progress of Cardano,” Hoskinson said, while also pointing to a new Plutus version, continued development of Aiken, and “node diversity coming this year,” alongside Leios.

Hoskinson also flagged developer activity he expects in March, referencing a “Dev Builder Fest down in Argentina” and describing the “integration of Pyth” into the ecosystem, which he presented as the arrival of a “tier one Oracle” for Cardano.

Beyond shipping timelines, Hoskinson used the livestream to argue that the industry’s central fight is shifting from enforcement actions to culture and narrative, particularly around non-custodial wallets and permissionless settlement. He warned about what he called “factions” that want crypto transactions routed through “permission federated networks owned and operated by large financial institutions,” and singled out US policy debates as part of that backdrop.

“What’s not okay is to build a network that’s forever owned and operated by five or 10 or 20 banks and they basically lord and leverage that power and position over the users,” he said. “And once they have absolute control, they just simply flip a switch and you’re at their mercy and they own all your money. And unfortunately, the system is moving in that direction right now.”

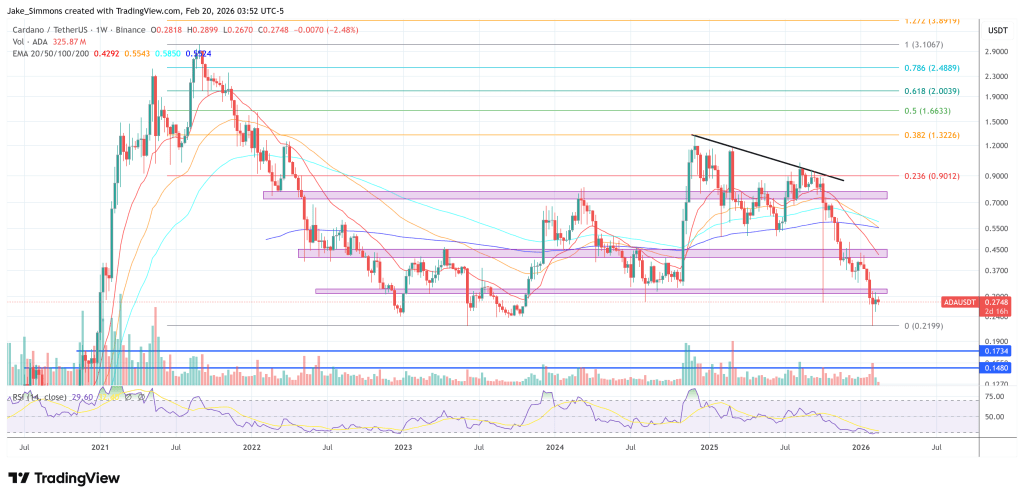

At press time, ADA traded at $0.2748.